Yesterday, the House Small Business Committee held a hearing on how small businesses use intellectual property. And, as has happened before, promoting patents—but not necessarily promoting progress—offers data that doesn’t hold up to scrutiny.

Chris Israel is an IP lobbyist for American Continental Group, with clients including Comcast, the Copyright Alliance, and Time Warner. He’s also the Executive Director of the “Alliance of U.S. Startups and Inventors For Jobs”, an organization focused on reverting the improvements to patent law made over the past few years.[1. Based on their public filings, USIJ appears to pay much of the money it receives to ACG for lobbying services. See, for example, USIJ’s 990 and ACG’s lobbying receipts from USIJ.] Israel focused his testimony on how the improvements to the U.S. patent system over the past fifteen years have impacted venture capital funding, citing a report his organization released. But he gets the data wrong, and even where he has the right data, his conclusions are questionable. At best, his testimony suggests the misunderstanding that technology neither changes nor develops over time.

Israel Gets The Data Wrong

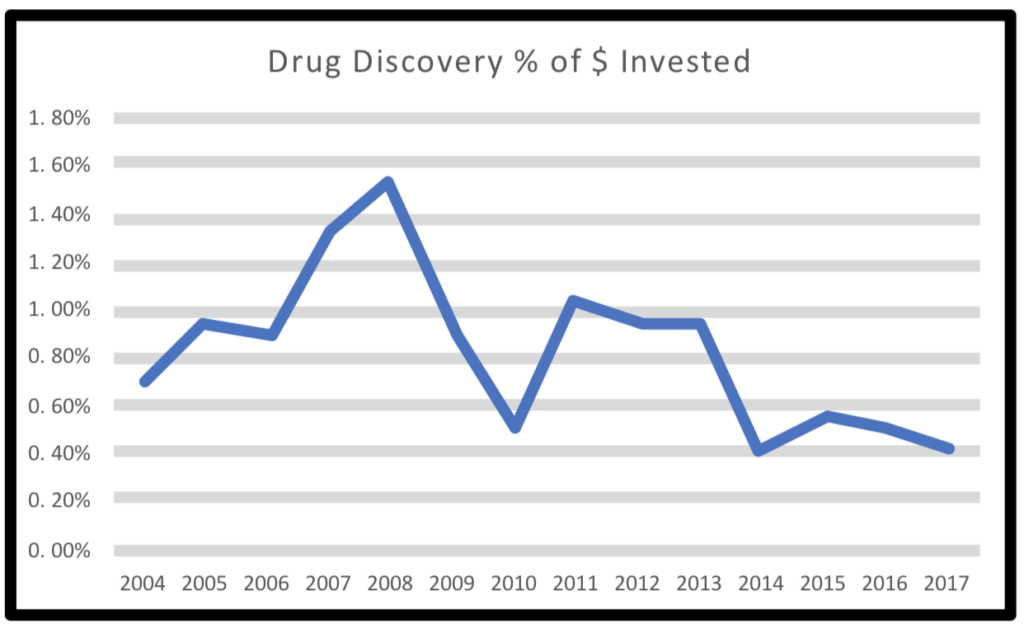

Israel complains about a decline in drug discovery VC funding. Here’s the relevant graph from his report:

The big problem with this is that this graph has literally nothing to do with drug discovery funding. It’s a graph of drug delivery funding—something completely different.

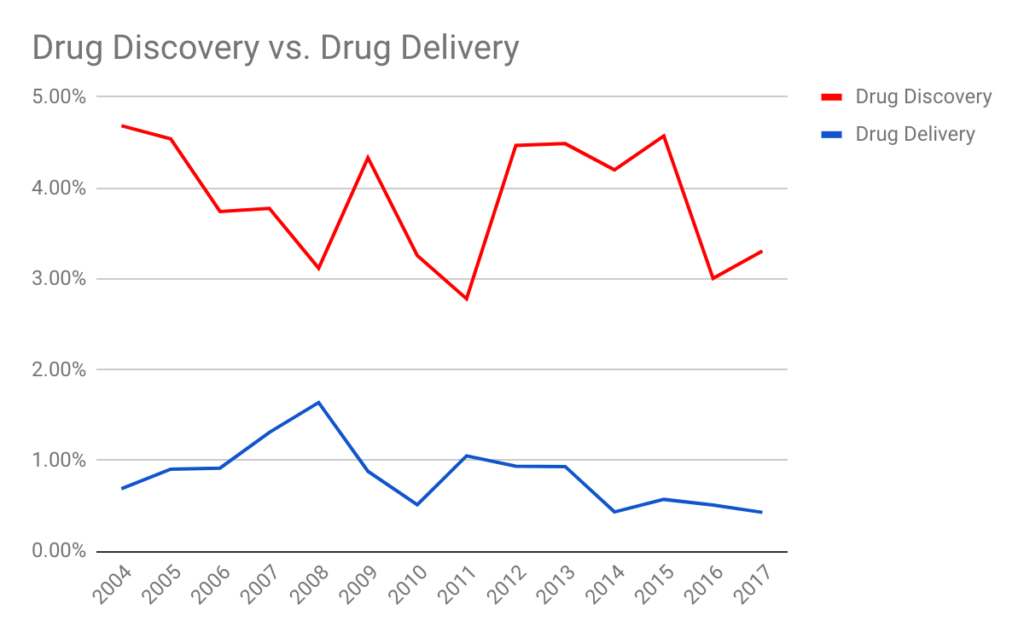

Here’s the two, graphed side by side, taken directly from the NVCA/Pitchbook data that Israel used.

By labeling drug “delivery” data as drug “discovery,” Israel has both misrepresented the total amount spent on it and also shown a “decline” that doesn’t exist.

And I put “decline” in quotes for a reason—it’s not a real decline. In 2004, about 0.7% of VC funding went to drug delivery. And in 2017, about 0.4% did. As Israel notes early in his testimony, “total venture capital investment in the United States increased nearly fourfold over the past 15 years.” But all of his conclusions are based off percentages of total venture capital funding.

In fact, drug delivery funding comprised a slightly smaller share of nearly four times more fundings. Drug delivery funding went from $151 million to $364 million—a smaller piece, but of a much bigger pie.[2. This general relationship—a slightly smaller piece of a much larger pie—holds true for quite a few of the other categories on his list, including surgical devices and operating system software.]

And funding for drug discovery, when we use the actual data instead of Israel’s incorrectly labeled data, went from $1.03 billion to $2.8 billion, even though 2017 was a down year for drug discovery funding. In other words, in the same period that Israel complains that funding for drug discovery has gone down, drug discovery had actually nearly tripled—in a bad year.

Israel Omits Important Data

That’s just drug discovery. There’s another major problem, and this one is hard to explain as an oversight.

Israel shows “pharmaceutical” VC investment. But that’s a loaded term, and in this case, it doesn’t mean what you might think it means. NVCA/Pitchbook define the pharmaceutical sector as “Manufacturers and distributors of established drugs/ pharmaceuticals.” In other words, venture funding into pharmaceuticals tells us little about advances in life sciences—it mostly tells us about investments in existing drugs.[3. NVCA does note that ‘pharmaceuticals’ companies may also perform research on new drugs, but the category as a whole is for companies dedicated more towards established drugs. Companies focused on new drug development fall into other categories.]

If we want to know about advances in life sciences, we really care about two other categories. Drug discovery—“Researchers and developers of new drugs”—and biotechnology—“Companies engaged in research, development, and production of biotechnology.” That’s new small molecules (like the hepatitis-C cures that have come out over the past few years) and new biologics (like the ever-improving array of monoclonal antibody cancer treatments emerging.)

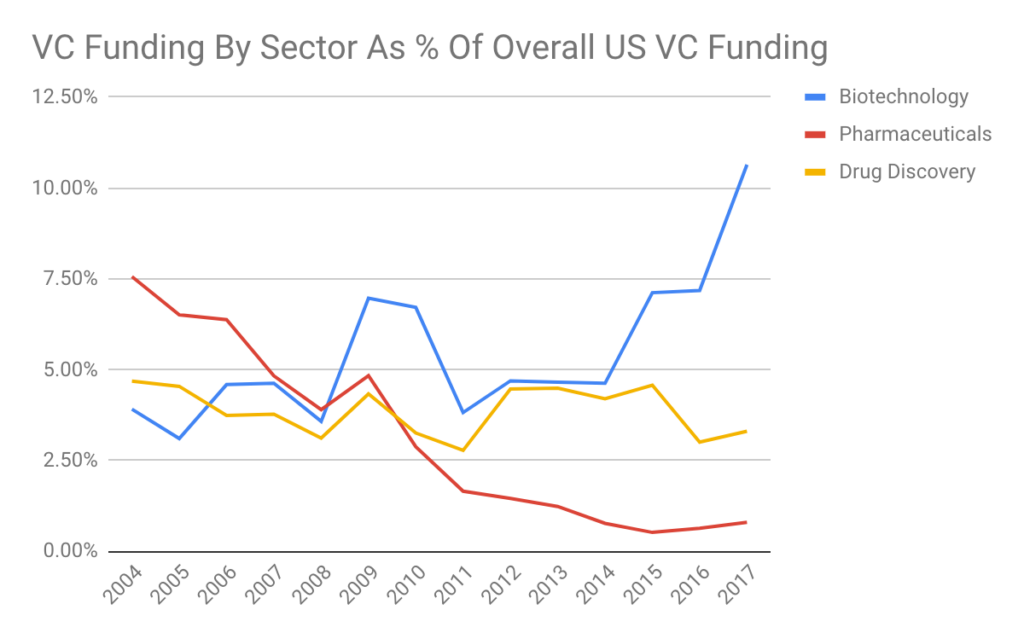

Here are drug discovery, biotechnology, and pharmaceuticals graphed together as percentages of overall U.S. VC funding, which tells a very, very different story.

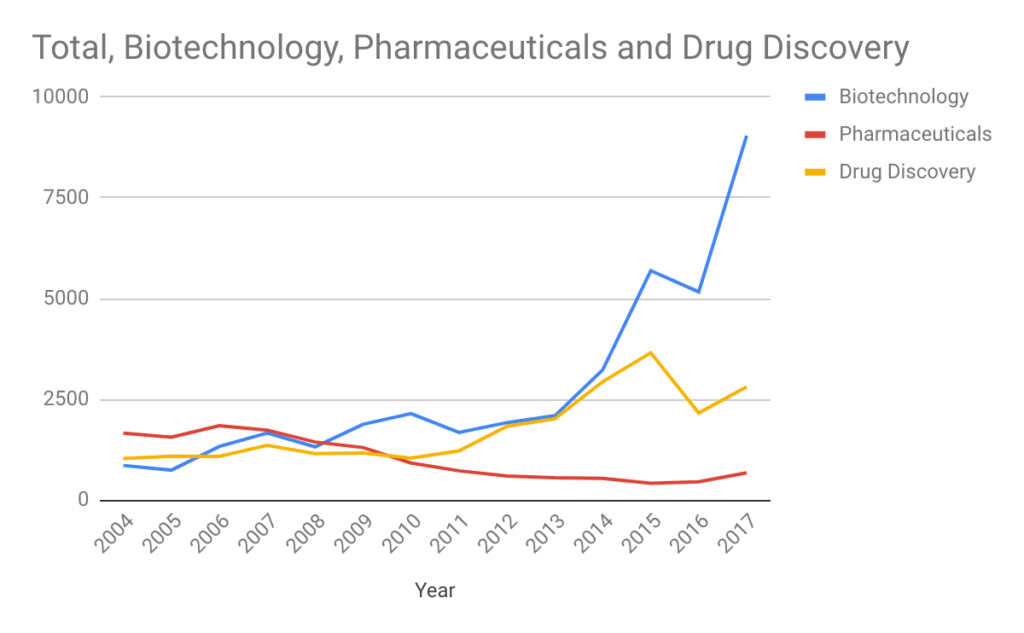

And here are all three graphed as the absolute funding amounts (Y axis in millions of dollars).

The only category that’s seen a decline in VC funding is established pharmaceuticals. Biotechnology, the single largest area of VC funding, the area that’s delivering treatments for diseases like cancer? It’s grown from $860 million in VC funding to over $9 billion.

Israel doesn’t show biotechnology at all.

The data shows a drop in one area of life sciences while hiding the rise of the new one that’s replacing it. It’d be like discussing funding for computers by looking only at servers and completely ignoring the billions of desktop PCs and mobile devices. When you look at all the data, life sciences VC funding appears to be quite healthy, including in the areas most associated with technological advance.

But don’t just take my word for it—I’ll quote from the most recent Pitchbook/National Venture Capital Association report on deal funding – “Life science investing is through the stratosphere.” How about Forbes? Just put out an article titled “Healthcare VC investing could hit a record high in 2018”?

There’s one other question I have about his dataset. He seems to be using NVCA/Pitchbook industry classifications. But he also calls out “Software apps” and “B2C technologies”, categories which—at least as of the NVCA/Pitchbook 2018 Yearbook—didn’t exist in that scheme. There is an “application software” category, but that’s defined as traditional task-focused applications like Microsoft Office or Adobe Reader, not ‘apps’ in the way Israel appears to be using the term. Similarly, there’s no “B2C” category. At one point the report references “Consumer Products and Services” (B2C), but that category is incredibly broad and includes everything from clothing to household appliances to cars to casinos to hotels to restaurants. And given that Israel breaks out “restaurants, hotels, and leisure” separately, if that’s what he’s referring to then he’s double-counting. It’s unclear how he categorized these areas and what he’s actually referring to.

Israel’s Testimony Doesn’t Address Changes In Technology

Israel focuses on semiconductors, life sciences, networking hardware and software. These are important industries. But sometimes reductions in investment happen as technologies mature, or as the underlying industries shift. For example, production semiconductors (“Owners and operators of semiconductor foundries”, per NVCA/Pitchbook) has seen a significant decline in VC funding.

That reflects two issues—a shift in the underlying industry, and the increasing cost of the equipment for making semiconductors. In this case, the semiconductor industry has moved heavily to a “fabless” model where a few large companies build semiconductors on contract for others. This is unsurprising, given that fabs are now multi-billion dollar enterprises just to build, with billions more required to develop new technology and to actually operate the fab. That’s far beyond the reach of almost any startup. But a semiconductor startup can relatively easily contract out for the manufacture of a chip they designed. This leads to a reduction in production semiconductor VC funding—but not one that should concern anyone.

Even when Israel’s statistics appear to show a problem, a deeper understanding of the underlying industry often shows that the apparent problem is actually just a mirage.

New Areas of Technology Lead to New Advances

Israel complains that there’s been an increase in investment in social networks, platforms, software apps, B2C technologies, and financial services. He claims that “these are not sectors that are investing heavily to push the outer boundaries of science and technology to remain competitive in a global market.”

But that’s simply false.

For example, social network and platform companies have invested billions of dollars in developing new software improving the efficiency of high-performance databases and new technologies that enable more efficient data centers for large-scale computing. Without that kind of technology, data centers like the ones that are enabling current advances in AI and drug discovery aren’t feasible. In fact, next week the National Institutes of Health are holding a workshop—participants will “hear from leading industry experts and scientists who are employing AI/ML in biomedical research settings.”

That’s not the only connection to AI, either. Social networking and platform companies have invested in (and released for public use) basic AI research, producing tools like TensorFlow (Google) and PyTorch (Facebook). These direct products also have follow-on impacts, enabling others to push the outer boundaries of science and technology.

There’s a ton of amazing work going on out there in AI right now. A lot of small companies are creating new ideas built on a machine learning substrate.

But that machine learning substrate probably utilizes one of those AI tools produced by a social network or platform company, and many of them run on ubiquitous compute platforms like Amazon Web Services provided by B2C service companies. Those “platform” and B2C VC investments that Israel is complaining about are why AI is now within the reach of any company, not just companies with the capital to build their own compute farm.

And once a small company has built their AI-driven product? That small company can begin selling to anyone, anywhere, using a service like Amazon or eBay’s B2C platforms.

This failure to understand the importance of areas of software like platforms or B2C technologies suggests an underlying inability to understand how technology has developed over time, with new sectors taking on new importance to our national economic growth. While semiconductors and pharmaceuticals are, and will remain, an important area of technology, failing to acknowledge the importance of new areas of research is dangerous and risks the United States falling behind in these critically important new areas.